A Guide to Spain's Rental Registration Number

Understanding Spain's Rental Registration Number (NRA) and Single Tourist Rental Registry (STR)

If you’re renting out a property in Spain for short-term stays, be it a cosy apartment in Malaga, a countryside villa in Granada or a penthouse in Valencia, it’s essential to be aware of the new regulatory changes. Once again, the goalposts are being moved to reduce the number of tourist rentals in Spain and also to reduce the number of illegal ones. The latest system is the Single Tourist Rental Registry (STR) or NRA Rental Registration Number (NRU/NRUA/URN).

Starting July 1, 2025, Spain requires all short-term rental properties to obtain a Rental Registration Number (Número de Registro de Alquiler/Número de Registro Único de Alquiler). This is done by registering on the Registro Único Digital, also known as Ventanilla Única Digital (VUD) to advertise and operate legally. This guide will walk you through the essentials of the NRA, its significance, and how to be compliant.

Contact us if you want us to apply for the new NRA for you. The cost is €100, plus a Land Registry fee of €27 (+IVA).

Or, even if you’re stuck at the NRA Land Registry submission stage. We do the NRA application service remotely, so even if you are not currently in Spain, we can get you an NRA tourist rental license and even provide a digital certificate.

We are upfront about what you need to have a sucessful application. We will tell you if we think your NRA tourist rental license application will be rejected, rather than just take your money like other agencies/gestors.

We also offer an Annual NRA Renewal Service, so you don’t have to go through the same stress this year!

What is a Rental Registration Number (NRA)?

The NRA (or NRUA, NRU) or URN National Registration Number as some booking platforms are calling it, is a unique identifier assigned to properties offered for short-term rentals in Spain. This includes entire homes, individual rooms, and even boats used for accommodation. Introduced under Royal Decree 1312/2024, the NRA aims to centralise and regulate the fast-growing short-term rental market across the country. Once obtained, this number must be prominently displayed on all rental listings, including platforms like Airbnb, Booking.com, and Vrbo.

Failure to show this number may cause your listing to be removed by online platforms starting July 1, 2025.

In some regions, a non-tourist NRA can be obtained if you only plan on offering non-tourist, seasonal lets.

Contact us to check if you can obtain an NRA number even if you haven’t got a rental tourist licence.

What Is the Single Tourist Rental Registry?

The Single Tourist Rental Registry (STR) is a centralized database that requires all properties offered for short-term or seasonal rentals in Spain to be officially registered. Each registered property receives a unique identification number, which must be displayed in all advertisements. The Ventanilla Única Digital de Arrendamientos (VUDA) system was established to ensure that all tourist accommodations meet legal requirements and to facilitate better oversight of the rental market. This was maybe a backlash due to people failing to registering their VUT.

When Does the Regulation Come into Effect?

While the NRA system became operational on January 2, 2025, compliance became mandatory from July 1, 2025. This grace period allows property owners to familiarise themselves with the new requirements and complete the registration process. We have done this process many times and like most Spanish admin, it can be a nightmare.

As you’ve probably seen in the news, the government is already applying pressure to rental platforms to remove listings without a valid NRA. We strongly advise you apply as soon as possible if you haven’t already got an NRA number.

Contact us for an NRA number in Malaga, Murcia, Valencia, Alicante, Barcelona, Madrid, Bilbao or even Lanzarote.

How to Get a Rental Registration Number (NRA)

Follow these steps to register on the Single Tourist Rental Registry and apply for your Rental Registration Number in Spain:

- Gather Necessary Documentation:

- Property details: exact address, cadastral reference, and maximum occupancy.

- Specify whether you’re renting the entire property or individual rooms.

- Valid tourist license if required by your Autonomous Community.

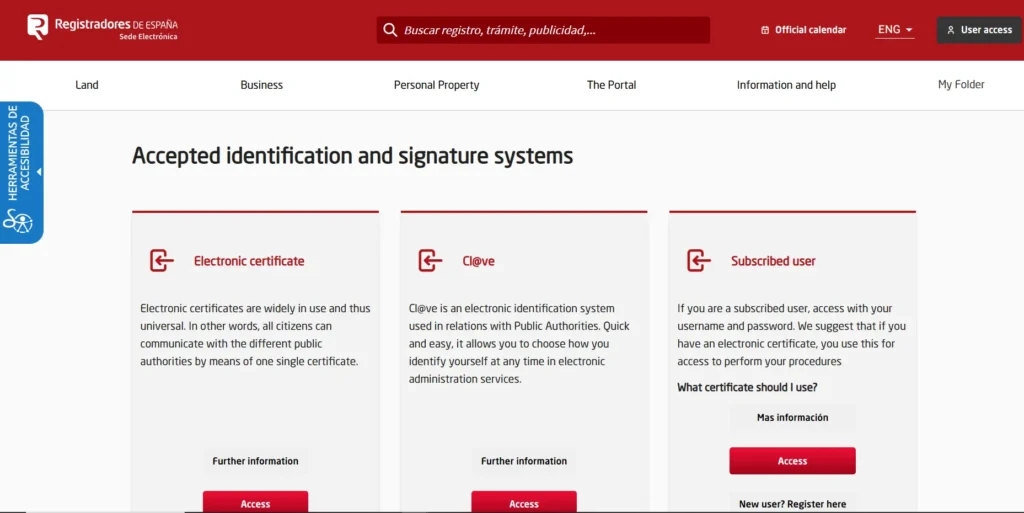

- Access the Registration Portal:

- Visit the Spanish Land Registries website.

- Log in using a valid electronic digital certificate for identification.

- Complete the Application:

- Fill out the online form with the gathered information.

- Submit the form and any additional required documents.

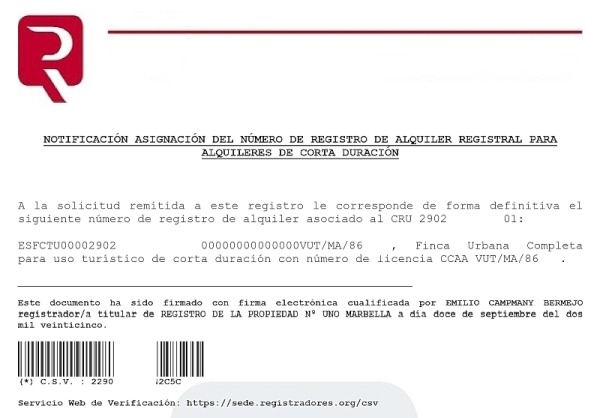

- Receive Your NRA:

- Upon successful submission, you’ll receive your unique NRA, which must be displayed on all rental listings.

Note: The registration fee is €27 per application, excluding taxes. If you’re renting the property for both tourist and seasonal purposes in some regions such as Valencia (Comunitat Valenciana), separate NRA registrations are required for each.

NRA Number Rejections

As of July 1st 2025, nearly 20,000 NRA number applications have been rejected with the number on the rise. There are various reasons for rejection, even if you have a valid tourist licence. We have discussed this in the article, NRA number rejection reasons and ways to fix them.

Many have become frustrated with being rejected and the increasing hoops they have to jump through to rent their property out. Some are selling their properties, turning to longer term rentals or building their own rental property website to advertise them.

GET YOUR NRA NUMBER

Don’t wait until your property is removed from your rental booking site, or worse, you receive a fine. We can apply for your NRA rental registration number for you for €100 (+ land registry fee). Provisional NRA number usually obtained within 48 hours.

What to Do Once You Have Obtained an NRA

After obtaining your Rental Registration Number :

- Update Listings: Ensure that the NRA is prominently displayed on all rental platforms and advertisements.

- Maintain Compliance: Keep your property in line with safety and quality standards as stipulated by local regulations.

- Annual Reporting: Submit a yearly report detailing rental activities, including anonymized lease data and the purpose of each lease.

- Stay Informed: Regularly check for updates or changes in regulations, especially those specific to your region or municipality.

What Happens If You Don't Get an NRA?

Failing to obtain an NRA can lead to several consequences:

- Financial Penalties: Operating without a Rental Registration Number can result in fines, the amount of which may vary depending on regional laws.

- Listing Removal: Rental platforms are obligated to remove listings that lack a valid NRA, effectively halting your rental operations. Recently Spain ordered Airbnb to withdraw more than 65,000 holiday rental listings.

- Legal Action: Continued non-compliance may lead to legal proceedings, further fines, or other sanctions.

- Community Restrictions: In some areas, homeowners’ associations have the authority to prohibit or restrict short-term rentals. As of April 3, 2025, obtaining explicit approval from your homeowners’ association is mandatory for tourist rentals.

NRA/NRUA Annual Renewal Report

Under the recent Orden VAU/1560/2025, all owners with a Rental Registration Number (NRA/NRUA) are now required to submit an annual activity report to the Property Registry. This report is mandatory even if your property had no guests during the year.

The filing window is strictly during February 2026, and the first report is due in February 2026 to cover your 2025 activity. This report is separate from your daily police guest registrations; it is a yearly summary used by the government to verify that your property is being used correctly. Failing to submit this on time may result in your registration being cancelled, preventing you from legally advertising on platforms like Airbnb or Booking.com.

To make this easy, keep a simple excel spreadsheet throughout the year. Record your guest count, the dates, and the “reason” for their stay (Holiday, Work, etc.). When February rolls around, you (or your authorised representative) will be ready for the new depósito de arrendamientos de corta duración.

The easiest way to do this will be by using the N2 software that the land registry has provided for download from their site.

We have an NRA Annual Renewal Service for those thad had enough navigating the system the last time.

For more information check out our Annual NRA/NRUA Renewal Report page.

Or you can Google ‘How to submit the N2 Facebook’ and follow Bazza from the bar’s instructions.

Impact on Non-Resident Property Owners

Tax Obligations

Even after registration, non-resident owners are responsible for fulfilling tax obligations in Spain. This includes:

- Rental Income Tax: Non-EU residents must declare rental income through Form 210 (Modelo 210). A recent change in the law (July 2025) allows you to pay 24% tax on your net income (income after expenses), instead of 24% on your gross income, the same as EU/EEA residents. We have teamed up with local tax experts to offer tax accounting services, such as Modelo 210 submissions.

- Imputed Income Tax: If the property is not rented out for the entire year, owners are still liable for a tax based on the property’s value, reflecting potential rental income.

- Local Taxes: Owners must also pay local taxes such as the Impuesto sobre Bienes Inmuebles (IBI), which funds municipal services.

Compliance with Local Regulations

In addition to national requirements, non-resident owners must adhere to regional and municipal regulations. For instance, some areas may require a tourist license or impose restrictions on rental activities. It’s essential to consult local authorities or legal experts to ensure full compliance.

Why is the NRA Necessary?

The introduction of the NRA serves multiple purposes:

- Regulation and Oversight: With the rapid growth of short-term rentals, the NRA helps authorities monitor and manage the sector effectively.

- Safety and Standards: Ensures that rental properties meet specific safety and quality standards, providing peace of mind to guests.

- Tax Compliance: Facilitates better tax collection and reduces instances of tax evasion in the rental market.

- Market Transparency: Creates a transparent system where guests can verify the legitimacy of rental properties.

- Community Impact: Addresses concerns about housing shortages and the impact of short-term rentals on local communities.

In Summary

The introduction of the Rental Registration Number (Registro Único de Arrendamientos) is a significant step towards regulating Spain’s short-term rental market, ensuring safety, compliance, and fairness for all involved. By understanding and adhering to these new requirements, property owners can continue to offer their accommodations confidently and legally. It ensures more trust from tourists, leading to more bookings.

If you need assistance with the new rental registration process, contact us today. The cost is €100. There is also a Land Registry fee of €27 (+IVA) to pay. We can even do it remotely if you are not currently in Spain and can apply for a digital certificate in your behalf, if you need one. We also offer an NRA Annual Renewal Service so you don’t have to stress about it every year.

Regional Differences Affecting NRAs

As with most procedures in Spain, rules vary across different regions. Here are some of the variations or differences that affect tourist rental licences and NRAs.

Disclaimer. Please note the information on this page is for informational purposes only. Rules seem to be getting changed and updated regularly as this is a new process and so for definitive rules please contact your local land registry office.

NRA in Comunitat Valenciana

Definition of Tourist-Use Housing (VUT)

- In Valencia, a “Vivienda de Uso Turístico” (VUT, tourist-use housing) is defined as a whole property rented out for 10 days or less to the same tenant.

- Renting by individual rooms is not allowed for VUTs – the whole dwelling must be made available.

- The property must have an individualized cadastral reference. This means that you cannot split one property into multiple dwellings.

Length of Stay Distinction

- ≤ 10 days: considered tourist rental, so subject to VUT regulation.

- 11 days or more: not considered a tourist rental under the regional law – these falls into seasonal rentals (“arrendamientos de temporada”).

Implications for “Seasonal” Rentals (11+ Days)

- For leases of 11 days to 11 months, these are treated as seasonal rentals (under the LAU, Ley de Arrendamientos Urbanos) rather than tourist rentals.

- Because they are not VUTs, they don’t need the tourist license, but they still need to register by obtaining an NRA according to national law (if they qualify as “arrendamiento de corta duración” under that regime).

- These longer-term leases avoid some of the stricter tourism-specific licensing burden.

Contact us for an NRA registration number in Ruzafa, Benidorm, Alicante, Dénia, Jávea, Torrevieja, or Orihuela Costa.

NRA in Andalucia

Definition of “Vivienda de Uso Turístico” (VUT)

- Under Decreto 31/2024 (which modifies the old VUT law in Andalucía) they clarify that dwellings rented for more than 2 continuous months to the same tenant are excluded from “viviendas de uso turístico.”

- That means if a lease is “seasonal” or long enough (> 2 months), it may not count as a tourist VUT from the regional-tourism-use legal perspective.

- Because of the national register, even “seasonal lets” (if they qualify as “corta-duración” per the national law) may require the NRA.

Contact us for an NRA registration number in Malaga, Marbella, Almeria, Cádiz, Granada, Nerja, Seville or Córdoba.

NRA in Murcia

What Counts as a “Seasonal” Let in Murcia?

- Because VUT regulation applies to temporary tourist rentals, not all “temporary” leases are VUT – some may simply be seasonal leases under LAU (Arrendamiento Urbanos) if they’re not being “marketed tourist‑wise” or if the contract uses LAU.

- A “seasonal lease” in Murcia could therefore be:

1. A contract under LAU (arrendamiento de vivienda) – if the owner and tenant agree on a temporary purpose, and it’s not being treated as a tourist‑use dwelling.

2. A rental of several months, even many months, without being classified as VUT, as long as it’s under LAU and not “commercialized via tourist channels” in the sense of Decree 256/2019.

Contact us for an NRA registration number in Los Alcázares, San Javier, La Manga del Mar Menor, Cartagena, or Lorca.

NRA in Canary Islands

Short-term (Tourist) Lets in Canarias

- Must comply with both regional “VV / vivienda vacacional” rules (or the new LOSUTV law) and the national NRA requirement.

- Need an active tourist‑use regime (via the regional tourist register) and include the NRA in listings.

- Must justify “temporary use” in VV property sense (per regional regulation).

“Seasonal” / Longer‑Term Lets

- The national NRA law explicitly covers “arrendamientos de temporada” (“seasonal lets”) as part of the registry requirement.

- Even if a lease is more “residential / seasonal” than tourist, if it’s being offered on platforms and rented short-term, the NRA applies.

- However, whether it qualifies as a VV under Canary regional law depends on “promoted on tourist‑offer channels” and “habitual” temporary leasing. If not “habitual” or “touristic,” it might not fall under VV regulation, but it still needs NRA.

Contact us for an NRA registration number in Tenerife, Fuerteventura, Gran Canaria, Lanzarote, La Palma, La Gomera, or El Hierro.

NRA in Balearic Islands

Short-Term / Tourist Lets

- These are clearly covered by both the state NRA (for short‑duration rentals) and the Balearic tourist‑rental regulation (especially under the Balearic tourism‑containment legislation).

- Owners must be careful: if they operate a tourist let, they need an ETV licence and NRA and comply with Balearic rules (e.g., limits on new tourist units in multifamily buildings under Decreto 4/2025).

Seasonal Lets (Temporal / de Temporada)

- These are also included in the scope of the national short‑term registry, per RD 1312/2024.

- “Seasonal” in this context means a temporary purpose (vacational, work, study, etc.), not necessarily a permanent residence. This aligns with the concept in the national registry.

- Even if a let is “seasonal” and not purely tourist, it is subject to the NRA if offered via short‑term accommodation platforms.

Contact us for an NRA registration number in Mallorca, Menorca, Ibiza, or Formentera.

NRA in Comunidad de Madrid

Short-Term / Tourist Lets

- Tourist rentals (short-term) are from 1 – 31 days. They require a VUT license (Vivienda de Uso Turístico) and NRA number (VUD ID – Ventanilla Única Digital ).

- If your property is within Madrid City, the Plan RESIDE (2025) effectively prohibits “scattered” tourist flats in residential buildings. This means you can only operate a VUT if the entire building is dedicated to tourism or if the apartment has a separate street entrance independent of the residential neighbors.

Seasonal Lets (Medium term)

- Lets of 32 days – 11 months. No VUT licence is necessary, however, you must have a valid Certificate of Habitability (Cédula de Habitabilidad) and an Energy Efficiency Certificate.

- “Seasonal” in this context means a temporary purpose (vacational, work, study, etc.), not necessarily a permanent residence. The contract must explicitly state the temporary cause (e.g., “Student enrolled at IE University for 9 months”) and the tenant’s permanent address elsewhere.

- Even if a let is “seasonal” and not purely tourist, it is subject to the NRA if offered via short‑term accommodation platforms.

Contact us for an NRA registration number in Alcalá de Henares, Torrejón de Ardoz, Móstoles, Getafe or Alcorcó.

NRA in Catalonia

Seasonal / “Alquiler de Temporada” (Non‑Tourist Short‑Term)

- Under the national register (RD 1312/2024), “alquiler de temporada” (seasonal rentals) are included in the short‑term registry. This means that even non‑tourist, temporary lets of short duration must register and get an NRA.

- A seasonal let in Catalonia is classed as from 32 days to 9 months in duration.

- However, for “tourism‑rural” (casas rurales) in Catalonia, there’s some legal uncertainty: Rural‑tourism associations argue these should be excluded from the NRA’s scope, because such accommodations are regulated under Decreto 75/2020 (Catalan tourism regulation) and treated like establishments (not simple VUT).

Contact us for an NRA registration number in Barcelona, Girona, Lleida, or Tarragona.

FAQ

What is the NRA, and why do I need one?

The NRA is a unique identification number assigned to each short-term rental property in Spain. It is mandatory for listing properties on online platforms like Airbnb and Booking.com. Without this number, listings will be removed from these platforms starting July 1, 2025.

How do I apply for an NRA?

Applications can be submitted online through the official platform, the Digital Single Window for Rentals. You’ll need to provide property details, proof of ownership, and compliance with local regulations. A fee of €27 (excluding taxes) applies. More information above.

What information is required for the NRA registration?

You’ll need to provide:

Property address and cadastral reference

Type of accommodation and maximum occupancy

Owner’s details

Proof of compliance with regional and local regulations

Tourist license (if applicable)

- Community of Owner’s approval (if applicable)

You can register for an NRA number yourself on the Registradores de Espana website. However, many people prefer to use an English speaking lawyer, gestor or agency to do it for them. This can ensure your application is successful as they have more experience in submitting NRA registrations. They will also know the usual reasons for rejections and how to overcome them.

Will my property listing be removed from holiday rental platforms if I don't get an NRA by July 1st 2025?

Starting July 1, 2025, platforms are legally obligated to ensure that all listed properties have a valid NRA. If a listing lacks this number or displays an invalid one, the platform must remove or disable the listing within 48 hours.

Contact us today if you want us to appy for an NRA for you.

Can I still get an NRA number after July 1st?

Yes, you can still register for the NRA after July 1st, 2025. However, failing to register by this date could result in fines or penalties, and rental platforms may remove listings that don’t display the NRA. Existing bookings may be affected if you don’t have the NRA, potentially leading to cancellations. Also, you will not be allowed to list a property on sites such as Booking.com and Airbnb after this date if you haven’t got an NRA number.

How long does the NRA last for?

The NRA doesn’t expire. However, you’ll need to complete an annual report to keep your listing compliant with the new Spanish Registro Único de Alquiler. This will include submitting a list of all rentals made during the registration period and proof that each rental was temporary. Failure to do so may result in suspension or revocation of the registration number. Contact us for more information, or if you want to join our Annual NRA Reporting Service.

Do I need an NRA if I rent out a room in my home?

Yes, the NRA requirement applies to all short-term rentals, including individual rooms, provided they are rented out for temporary purposes such as holidays, work, study, or medical treatment.

Can I list multiple units under the same license?

Each accommodation unit must be individually registered. If you rent out several rooms separately, each room requires its own registration number. Some regions, such as Valencia, do not allow rooms to be rented as the property will have only one Cadastral Reference. You must rent out the complete ‘unit’ associated with that reference.

What if I have split one property into numerous properties?

The national standard is – One Cadastral Reference = One Property. If your Cadastral Reference covers two physical apartments (e.g., you split a large flat but didn’t update the Cadastre), you will likely face a rejection or a requirement to fix the Cadastre before you can register.

In Andalucia, there is a clause allowing you to use a Deed of Division (División Horizontal) if the Cadastre is outdated. This enables you to prove each property is a seperate property.

What if my community of owners doesn't approve short-term rentals?

As of April 3, 2025, homeowners’ associations (Comunidad de Propietarios) can vote on whether properties within their buildings can be used for tourist rentals. A favorable vote of at least 60% is required. If your community disapproves, you cannot legally register your property for short-term rentals.

Do non-resident property owners still need a rental registration number?

Yes, non-resident property owners must also obtain an NRA to legally advertise and operate short-term rentals in Spain.

Do I need to cancel my tourist rental licence if I am no longer renting out my property?

Yes, you must cancel the tourist licence and inform the relevant authorities.

Are the NRA, NRU and NRUA all the same thing?

Yes, in simple terms they all relate to the rental registration number.

NRA means Número de Registro de Alquiler.

NRUA means Número de Registro Único de Alquiler or Número de Registro Único de Arrendamiento.

NRU means Número de Registro Único.

These all relate to a specific unique registration number that property owners in Spain must obtain to legally rent out their properties for short-term or tourist rentals.

Can I apply for an NRA number if I haven't already got a valid rental tourist license?

Yes. In most regions, you can apply for a NRA number for non-touristic use even if you haven’t got a rental tourist licence. This is called a seasonal let. This usually means that the property must be rented out for 11+ days and can not be let to tourists.

Do I need to register for two NRA numbers if renting my property for different purposes?

Yes. If your property is located in a region that permits tourist and seasonal rentals, you must register for a tourist and non-tourist NRA. For example, in Valencia, a tourist rental is classified as 10 days (or 9 nights). Anything above this is classified as a seasonal rental and is subject to different rules. Tourist rentals must have a previous tourist rental licence to be able to register for an NRA number.

Where can Simple English Advice apply for an NRA number?

We can obtain an NRA number for you in the whole of Spain. Including Madrid, Barcelona, Valencia, Seville, Zaragoza, Malaga, Murcia, Bilbao and Lanzarote.

What can I do if my rental property is removed from Airbnb, Booking.com or another rental platform?

If your rental property is delisted from a booking platform due to an NRA number rejection, you have the right to appeal. Due to the NRA rental registration being a fairly new process in Spain, it still has some teething problems. Most probably some of those will never get sorted out. Discover the reason for your property listing removal and check if it is a valid one. If so, you will have to fix whatever problem you have with the NRA submission and re-submit. If the reason is not valid and is clearly a mistake, contact support, gather evidence and file an appeal. The link leads to some common reasons for NRA registration rejections and how to fix them.

Can someone else manage my rental property for me in Spain?

yes, you can have someone else manage your rental property in Spain. Usually this is done by property management companies or rental agencies. You can have a friend or family member manage your property too, but there are usual hurdles to jump over to stay legal. They must have Power of Attorney to represent you or sign contracts etc. Also, if you pay them regularly they should be registered as Autónomo (self-employed).

It’s very important to make sure you have a legal contract between you and the managing company or individual. This Property Management Agreement is extremely important to cover yourself, especially if you’re not in Spain. Contact us if you need a Property Management Agreement for a rental property.

Can you renew my NRA/NRUA number in Spain?

Yes, Simple English Advice can submit your N2 NRA/NRUA annual activity form on your behalf. The fee is €85 + registration fee (€32).

EXCELLENT