Big News for Non-EU Property Owners in Spain:

Tax Rules Have Changed

If you’re a non-EU resident renting out property in Spain, there’s some excellent news. A recent Spanish court ruling (July 2025) has changed the way you’re taxed – and it could save you a lot of money. British citizens and other non-EU/EEA individuals who have rented out property in Spain can now deduct eligible expenses and also recover overpaid taxes from previous years. If you would like help preparing your annual accounts for a rental property, or with a rectification request to claim back previous year’s taxes, contact us today. More information about our Rental Income Tax Service below.

Deductible Expenses for Non-EU Residents Renting Property in Spain

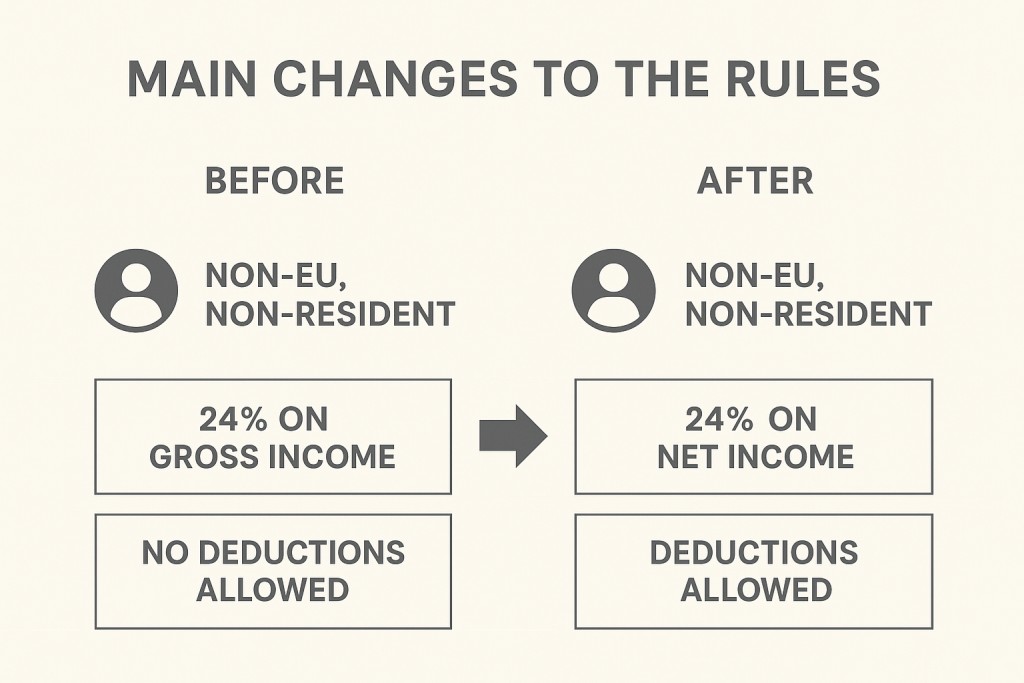

Up until now, if you were a non-EU landlord in Spain, you had it pretty rough:

- You were taxed 24% on your gross rental income (that’s before expenses).

- You couldn’t deduct any costs, such as maintenance, repairs, insurance, mortgage interest, or property management fees.

Meanwhile, EU and EEA landlords paid only 19% on their net income (after expenses). Pretty unfair, right?

What Changed in 2025?

In July 2025, Spain’s National Court ruled that this system was discriminatory. From now on:

- Non-EU residents can deduct rental expenses, just like EU/EEA residents.

- You’ll pay 24% tax on your net income (income after expenses), instead of 24% on your gross income.

This means you’ll finally be taxed fairly, based on what you actually earn – not on an inflated number that ignores your real costs.

What Expenses Can You Deduct?

Just like EU landlords, British and non-EU landlords can now subtract legitimate expenses such as:

- Mortgage & loan interest

- Local property tax (IBI)

- Insurance premiums

- Utilities (if you pay them)

- Repairs and maintenance

- Property management or agency fees

- Community fees

- Depreciation

Example:

A non-EU landlord earns €20,000/year gross rental income, with €7,000 in deductible expenses.

Before ruling → tax = €20,000 × 24% = €4,800.

After ruling → tax = (€20,000 – €7,000) × 24% = €3,120.

That’s a €1,680 saving.

* Keep good records and receipts – you’ll need them when filing your taxes.

You can also claim a possible rebate for the past four years (2021-2024). But be quick!

What This Means For You

- Accurate Deductions Now Allowed

Non-EU landlords can deduct legitimate expenses—just like EU counterparts—when filing Modelo 210. - Potential for Refunds

If you’ve been taxed on gross income previously, you may now request rectifications of past declarations (2021-2024) and claim refunds for overpayments on your rental tax. - Track & Document Expenses

Gather invoices for repairs, insurance, mortgage interest, IBI, utilities, etc. Proper documentation is critical. - Filing Still via Modelo 210

As of 2024, non-resident landlords can group their rental income annually, rather than filing quarterly. The deadline is from January 1 to January 20 of the year following the accrual. - Supporting Documentation

Supporting documentation (e.g., invoices, contracts, payment records) will be required.

What About Past Payments?

If you’re a British or non-EU property owner renting out property and have been paying 24% on your gross rental income in recent years, you may be eligible for a refund. Non-EU/EEA taxpayers may now request rectification of prior IRNR filings and claim refunds for undue payments for any non-prescribed tax years (currently: 2021–2024). Don’t wait as you lose the right to claim as each quarter passes.

The Supreme Court hasn’t made a final decision yet. However, it is advisable to file a Preventative Rectification now as you can only reclaim 4 years of overpaid taxes. This pauses the 4-year clock for your specific file.

Claims must be submitted to the Spanish Tax Agency (Agencia Tributaria) via formal rectification requests. If you would like help re-filing your Modelo 210 and claiming back previous years’ taxes, or preparing accounts for this year contact us today.

Don't Delay - Get Started Today

Simple English Advice have teamed up with financial experts to offer expert guidance on the new ruling, ensuring you get the best possible return for your investment. Our tax accounting service includes:

- Assessing and calculating your potential tax savings

- Preparing and submitting refund claims for previous years

- Keeping you informed of legal developments and changes

- Developing tailored strategies for your Spanish property investments

Don’t miss out on this opportunity to reclaim money that is rightfully yours. Claims can only only be backdated for four years (2021-2024), so each quarter that passes, you are losing money. Email us today to learn more about our rental income tax service.

The Bottom Line

This is a major win for fairness. The July 2025 ruling means that non-EU landlords renting out property in Spain will no longer pay tax on gross income, and can now offset legitimate expenses.

Next Steps:

- Start tracking all your rental expenses.

- File correctly using Modelo 210.

- Look into possible refunds for past overpayments.

The days of paying 24% on gross income are over – who’s got the champagne?

FAQ

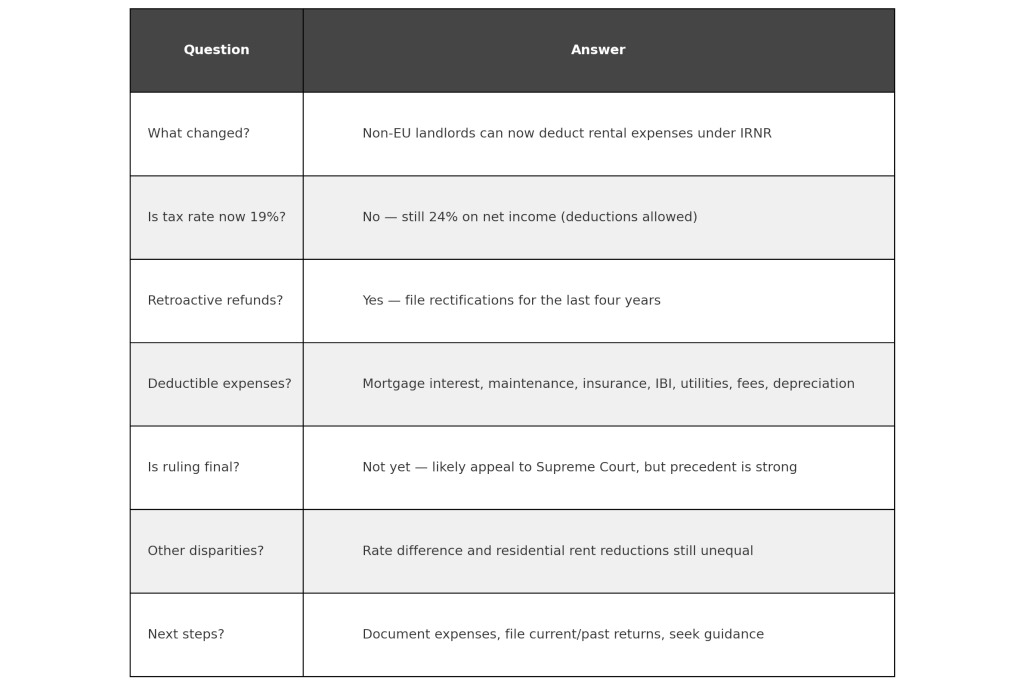

What changed with this ruling?

Until recently, only EU and EEA residents were allowed to deduct rental-related expenses from their gross income before paying Spain’s Non-Resident Income Tax (IRNR). Non-EU residents were required to pay tax on their gross rental income, with no deductions, even if they had significant costs such as mortgage interest, community fees, or maintenance.

The National Court (Audiencia Nacional) ruled on 28 July 2025 that this treatment was discriminatory and contrary to EU free movement of capital rules (Article 63 TFEU). As a result, non-EU landlords can now deduct eligible expenses in the same way as EU/EEA residents.

This levels the playing field, significantly reducing the effective tax burden for many non-EU property owners.

Does the tax rate also change to 19% for non-EU residents?

No. The ruling only affects deductions, not the tax rate.

- EU/EEA residents → pay 19% on their net income (income after deductions).

- Non-EU residents → must still pay 24%, but now it’s on net income instead of gross.

How to reclaim overpaid taxes for rental property in Spain?

Yes. Landlords who paid tax without deductions in the last 4 years can request a rectification of their Modelo 210 returns and claim refunds from the Spanish Tax Authority (Agencia Tributaria).

Generally, claims can be made for the previous four years (2021–2024).

You’ll need to provide evidence of expenses (invoices, receipts, utility bills, mortgage interest statements, etc.).

Refunds will be processed, but timelines may vary depending on administrative backlog.

This retroactive element could mean substantial reimbursements, especially for owners with mortgages or high property-related costs.

Is this ruling final, or could it be overturned?

The ruling is a major precedent, but it’s not absolutely final yet. The Spanish State may appeal to the Supreme Court. However:

The decision is strongly grounded in EU law principles (free movement of capital, non-discrimination).

Legal experts believe it is unlikely to be reversed.

Even if appealed, the precedent can still be cited in claims and refund applications.

So, while there’s a degree of uncertainty, the practical advice is to act now—file returns with deductions and submit refund claims.

Does this affect other discriminatory tax measures?

Yes and no. The ruling removes one key area of discrimination (deductions), but others remain:

Tax rate disparity: EU/EEA landlords pay 19%, non-EU pay 24%.

Resident vs. non-resident advantage: Spanish residents renting long-term for housing enjoy a 50–60% reduction in taxable income, which non-residents (EU or non-EU) cannot claim.

Several legal challenges are ongoing, particularly regarding the 24% vs. 19% rate. The July 2025 ruling may strengthen these cases by showing that Spain’s approach is discriminatory under EU law.

How should I proceed now as a non-EU landlord?

Track all expenses → start organizing invoices, bank statements, utility bills, mortgage interest certificates, etc.

File Modelo 210 with deductions → for quarterly or annual rental income returns.

Rectify past returns → claim refunds for the last 4 years.

Keep documentation for 4 years → in case of a tax authority audit.

Seek professional advice → Spanish tax law can be complex; a lawyer or tax adviser can maximize deductions and handle claims efficiently.

Monitor developments → watch for further rulings that may reduce the tax rate or expand rights.

This ruling makes Spanish property investment more attractive for non-EU owners, but proactive tax management is key.

FAQ Summary

EXCELLENT