F.A.Q.

FAQ about buying and selling a car in Spain

Yes, you must have a NIE or residency document to put a car in your name.

Yes, you must have one of the following to transfer ownership of a vehicle in Spain.

• Empadronamiento (updated)

• or property deeds/nota simple

• or rental contract. (Minimum 6-12 months)

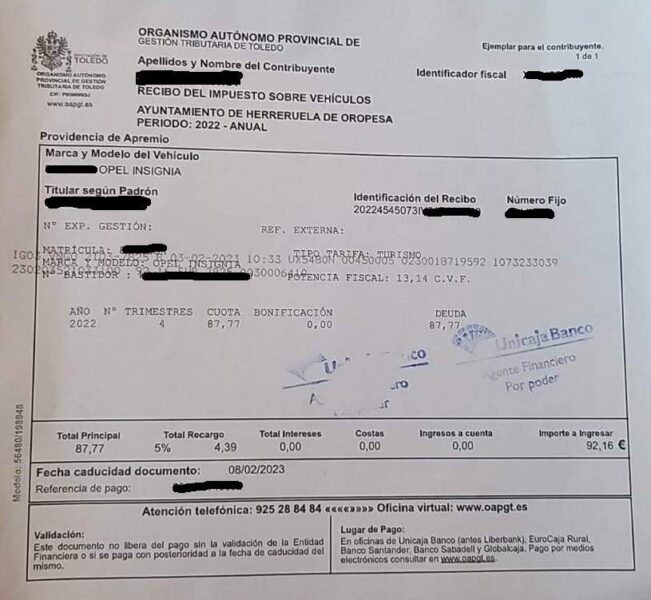

No, the previous years’ road tax must be paid before you can legally own the vehicle.

Yes, as long as you inform the buyer of the outstanding fines. It is still the seller’s responsibility to pay these fines. Depending on the debt, it may have to be paid before the vehicle can be transferred.

Yes, many buyer’s have bought cars with embargoes to then find they cannot transfer ownership. Always get a DGT vehicle check done before buying a second-hand vehicle.

You can request a detailed report from the Dirección General de Tráfico (DGT), called “Informe del Vehículo,” which shows any outstanding debts or fines.

The Modelo 621 (ITP) tax is the responsibility of the buyer. This tax can be very high depending on the value of the car and it’s worth trying to calculate it before buying a vehicle. You may then be able to negotiate a lower price with the seller.

Yes, we have transferred vehicles up to 2 years after the actual sale. As long as you have all the necessary documents and the previous years road tax is paid, it’s possible.

Yes, but if the last ITV test was a failure (unfavourable), you will not be able to put it in your name. The test must be favourable first before you can transfer the title. If the ITV is due or the date has passed, we recommend you ask the seller to pass the test before you buy it.

If the car has hidden defects not disclosed by the seller, you may have legal recourse. Under Spanish law, the seller is responsible for hidden defects (vicios ocultos) for six months from the date of sale. You can request a repair, price reduction, or even cancel the sale, depending on the severity.

You remain liable for fines and taxes until the car is registered in the new owner’s name. To protect yourself, notify the DGT of the sale with a Notificación de Venta. We also offer this service. To do this you must have the buyer’s details, NIE and a sales contract.

Yes, but you need to grant power of attorney (poder notarial) to a representative in Spain who can do it for you. Or, we can handle the transaction in your behalf.

No. The finance company must provide consent for the sale. The outstanding loan needs to be paid of first.

Be careful – even when a financed vehicle has been paid off it still can’t be transferred until the register has been cleared. The car will have placed a block against it called a “reserva de domino”.

This reserva de domino is registered in the “Registro de Bienes Muebles (register for movable goods)” and has to be cleared from there.