What's the Difference Between NIE, NIF and TIE?

Understanding Spain’s NIE, NIF, and TIE

If you’re planning to live, work, or conduct financial activities in Spain, you’ll quickly come across three key terms: NIE, NIF, and TIE. While they can seem confusing, understanding what each one represents will help you navigate Spanish bureaucracy more easily. Here’s a breakdown of what each of these means, who needs them, and when you’ll use them.

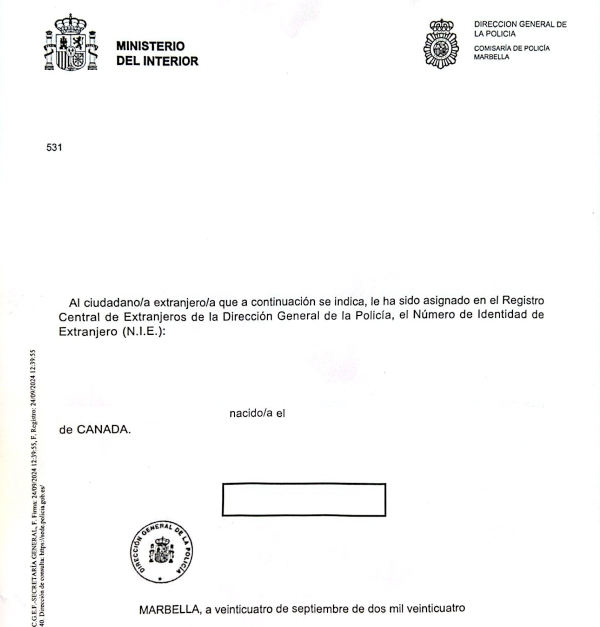

NIE: Número de Identidad de Extranjero (Foreigner’s Identification Number)

The NIE, or Número de Identidad de Extranjero, is a unique identification number assigned to foreigners in Spain. It’s essential for foreigners involved in any economic, legal, or financial activities, such as buying property, opening a bank account, or starting a business. The NIE doesn’t give residency status but instead acts as your tax identification number within Spain.

Who Needs a NIE?

• Non-residents who wish to engage in legal transactions (e.g., owning property or doing business) in Spain.

• Foreign residents who will be living or working in Spain.

Applying for an NIE is generally done through a Spanish police station or the Spanish consulate in your home country. The NIE is issued on a piece of paper and serves as a reference number for various official processes, but it does not include photo identification. This number never changes while you are a foreigner.

NIF: Número de Identificación Fiscal (Tax Identification Number)

The NIF, or Número de Identificación Fiscal, is essentially Spain’s version of a tax ID. For Spanish citizens, the NIF is the same as their DNI (Documento Nacional de Identidad) number, which functions both as an ID and a tax number. Foreigners, however, use their NIE as their NIF for tax purposes.

In summary:

• Spanish citizens use their DNI as their NIF.

• Foreigners use their NIE as their NIF.

You’ll encounter your NIF when dealing with anything tax-related in Spain, including paying taxes, submitting tax returns, and financial activities tied to residency status.

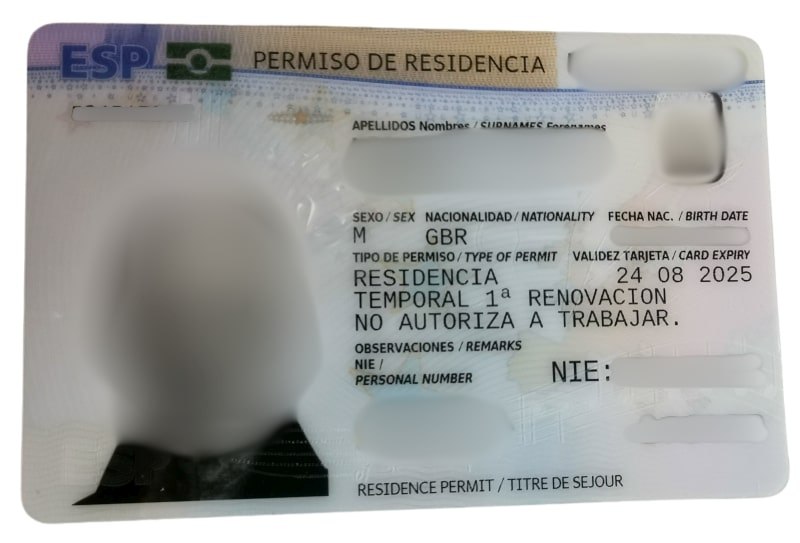

TIE: Tarjeta de Identidad de Extranjero (Foreigner’s Identity Card)

The TIE, or Tarjeta de Identidad de Extranjero, is a plastic card issued to non-EU residents who obtain residency in Spain. While the NIE is a unique identification number, the TIE serves as both an ID and residency card, displaying the holder’s NIE number, name, photo, and the type and duration of residency. The TIE is essential for non-EU citizens because it provides proof of their legal right to reside in Spain and includes additional information about their residency status.

Who Needs a TIE?

• Non-EU residents: This group, including British citizens post-Brexit, must apply for a TIE if they intend to live in Spain for extended periods.

• Temporary or long-term residents: For example, students from non-EU countries or those holding work or family residency permits.

The TIE card is obtained at your local police station or immigration office in Spain and usually requires scheduling an appointment. It is a more formal and complete form of identification for foreign residents and is recognised for various administrative tasks, including health insurance and social security registration.

Green Residency Certificate

The Spanish Certificado de Registro de Ciudadano de la Unión—commonly called the green residency certificate—serves as official documentation for EU citizens who have registered as residents in Spain. This certificate is a small green paper that includes essential information such as the holder’s name, address, nationality, date of registration, and unique NIE (Número de Identificación de Extranjero) number. It’s specifically for citizens from EU or EFTA (European Free Trade Association) countries and differs from the TIE card, which is issued to non-EU residents.

Many people from the UK still have this card rather than a TIE, and it is still valid (for now). We are finding there are some cases where government agencies are making problems for UK citizens with this card.

The new Entry/Exit Scheme (EES) that is due to be implemented in November 2024 (expect usual delays) on Spanish borders could cause problems for British citizens visiting Spain. British tourists will be required to provide details such as their name and have their fingerprints and photo taken at entry and exit.

Spanish residents who still have the old style green document may be in for bigger problems as they will no longer be recognised as legal proof of residency. According to GOV.UK, “Green Certificate holders may be wrongly identified as overstaying in the Schengen area and therefore, denied entry to Spain or other Schengen countries.”

If you are a resident of Spain and have this old-style certificate, we recommend you change it to a TIE card as soon as possible.

Differences Between NIE, NIF and TIE

- NIE: An identification number for foreigners in Spain. It’s required for both residents and non-residents for any financial or legal activity.

- NIF: Primarily a tax identification number used by Spanish citizens (and synonymous with their DNI) but equivalent to the NIE for foreigners.

- TIE: A physical card for non-EU residents that includes their NIE and serves as proof of legal residency, with additional personal and residency details.

While the NIE is simply a reference number, the TIE is an official ID for non-EU residents and includes a photo and specific residency details, offering greater simplicity in official processes for non-EU citizens. For more information check out our services or contact us at info@simpleenglishadvice.com